Understanding GIC

In the pursuit of higher education, many international students choose Canada as their preferred destination. However, financing education abroad can be a daunting task. One option that helps students fulfill financial requirements and secure a Canadian study permit is through a Guaranteed Investment Certificate (GIC). This comprehensive guide will walk you through the process of obtaining a GIC for studying in Canada, providing essential insights and tips for a smooth experience. Before delving into the specifics of obtaining a GIC for studying in Canada, it’s crucial to understand what a GIC entails. A Guaranteed Investment Certificate is a secure investment offered by Canadian financial institutions. It serves as proof of sufficient funds for international students to cover living expenses during their stay in Canada. It takes a lot of planning and perseverance to land in Canada and start your higher education. To make the process smoother, it is always a good idea to go through the requirements put in place by the Canadian Government. One such requirement is the GIC. Here is everything you need to know about this critical document:

What is GIC?

GIC stands for Guaranteed Investment Certificate and serves as proof of funds to make you eligible for getting a Canadian Visa. This is for students who choose to study in Canada under the SDS (Student Direct Stream) programme. You will not require any extra financial documentation to demonstrate to the IRCC (Immigration, Refugees and Citizenship Canada) that you have sufficient cash to cover the tuition and living expenses.

How does the GIC work?

To get your GIC, you will need to make a short-term liquid investment with a Canadian bank, usually for up to a year. The recommended amount of the investment is CAD 10,000- 15,000. You will be able to access this only once you are in Canada. This investment covers the living expenses for your first year in Canada. The money is released to you every month or every two months for the first 12 months after the confirmation of your identity.

Any one of the following must be provided by the bank where you buy your GIC:

- GIC certificate

- letter of attestation

- confirmation of Investment Balance

- confirmation of Investment Directions

Researching Eligible Institutions

To initiate the process of obtaining a GIC, the first step is to research eligible Canadian financial institutions that offer GICs for international students. It’s essential to choose a reputable institution with a solid track record and compliance with regulatory requirements.

Applying for Admission

Before applying for a GIC, prospective international students must secure admission to a recognized Canadian educational institution. Admissions acceptance is a prerequisite for most GIC programs, as it demonstrates the student’s commitment to pursuing education in Canada.

Gathering Required Documentation

To proceed with the GIC application, gather all necessary documentation, including the letter of acceptance from the Canadian institution, passport, and any other identification or financial documents required by the selected bank.

Initiating the GIC Application Process

Once all required documents are in order, initiate the GIC application process with the chosen financial institution. This can often be done online or through designated representatives in your home country.

Depositing Funds

Upon approval of the GIC application, the next step is to deposit the required funds into the GIC account. The amount varies depending on the institution and specific program requirements but typically ranges around CAD $10,000.

Receiving Confirmation

After successfully depositing the funds, the bank will provide confirmation of the GIC purchase. This confirmation is a crucial document required for the study permit application.

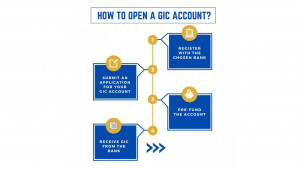

How to Open a GIC Account?

Since you need to open your Canadian bank account before arrival, this process is completely online. The procedure is pretty straightforward and time-efficient. While the process may vary slightly from one bank to another, here is typically what you need to do to open your GIC account:

Designated GIC banks in India

You can’t purchase your GIC at just any bank. It is always a good idea to stick to the list of Indian banks approved to offer GIC for Canada. These include:

Applying for Study Permit

With the GIC confirmation and other necessary documents in hand, proceed to apply for a study permit through the Immigration, Refugees, and Citizenship Canada (IRCC) website or the nearest Canadian embassy or consulate.

Accessing GIC Funds

Once in Canada, students can access the funds from their GIC account, which are typically disbursed in installments to support living expenses during the course of their studies.

Exploring Additional Financial Assistance

While the GIC serves as a primary source of financial support for international students, exploring additional avenues of financial assistance such as scholarships, grants, or part-time employment can further alleviate financial burdens.

Read More| Difference Between SDS and Non-SDS Visa Applications

Planning Financial Management

Effective financial management is crucial throughout your academic journey in Canada. Budgeting wisely, tracking expenses, and seeking financial guidance when needed can help ensure a smooth and stress-free experience.

Understanding GIC Terms and Conditions

Before committing to a GIC, carefully review the terms and conditions outlined by the financial institution. Familiarize yourself with the maturity period, interest rates, withdrawal restrictions, and any associated fees or penalties.

Building Credit History

Establishing a positive credit history in Canada can be beneficial for future financial endeavors, such as renting accommodation or applying for loans. Responsible use of financial products, including the GIC, contributes to building a favorable credit profile.

Seeking Guidance from Academic Advisors

Academic advisors and student support services are valuable resources for navigating the intricacies of studying in Canada, including financial matters. Don’t hesitate to reach out for guidance and assistance whenever needed.

Embracing Cultural Experiences

Beyond academic pursuits, studying in Canada offers rich cultural experiences and opportunities for personal growth. Engage actively in campus life, explore diverse communities, and immerse yourself in Canadian culture for a truly enriching experience.

Conclusion

Securing a Guaranteed Investment Certificate (GIC) is a pivotal step for international students planning to study in Canada. By following the outlined steps and leveraging available resources, students can fulfill financial requirements, obtain a study permit, and embark on a rewarding academic journey in one of the world’s leading education destinations.

Get assistance to study abroad from our international education experts at Gateway International and get free online consultancy for study abroad who can help guide you throughout your study abroad journey & avail our wide range of services for students on destinations like study in UK, study in USA, study in Canada, study in Ireland, study in Australia , study in the Netherlands and many other countries.

FAQs

How long does it take to receive a GIC confirmation?

The timeline for receiving GIC confirmation varies depending on the financial institution and individual circumstances. Generally, it can take a few business days to a few weeks from the date of application approval.

Are there any fees associated with obtaining a GIC?

While some banks may charge administrative fees or account maintenance fees, the GIC itself typically does not incur additional charges. It’s essential to review the terms and conditions provided by the bank for full transparency on any associated fees.

Is the GIC refundable if my study plans change?

In most cases, GIC funds are refundable if there is a change in study plans, such as visa denial or deferral of admission. However, each financial institution may have specific policies regarding refunds, including applicable conditions and processing fees.

What happens if I don’t use all the funds from my GIC?

Unused funds from the GIC remain in the account until the maturity period expires. After maturity, students can withdraw any remaining funds, subject to applicable terms and conditions, or choose to reinvest them as desired.

How can I monitor my GIC account and transactions?

Most Canadian banks offer online banking services that allow students to monitor their GIC account activity, track transactions, and manage funds conveniently from anywhere with internet access.